Record-low pricing and the environmentally beneficial attributes of renewable energy continue to drive record demand. In many cases, new wind and solar projects are now built for less than the cost of operating existing fossil-fired power plants.[1]

In the last couple years, many states, cities, and utilities have expanded their existing renewable energy goals. Eight states, Washington DC, and Puerto Rico have all committed to 100 percent clean energy in the coming decades.[2] In fact, projections show the wind and solar industries must install approximately 40 gigawatts of new power each year, every year from now until 2050 in order to reach the United States’ climate goals.[3] Despite this progress, significant challenges remain in delivering the clean, low-cost renewable energy many entities, including some of the largest American corporations, are demanding. Preeminent among those challenges is a lack of adequate transmission, according to a recent report produced by the ScottMadden for WIRES.

Source: Informing the Transmission Discussion, ScottMadden for WIRES

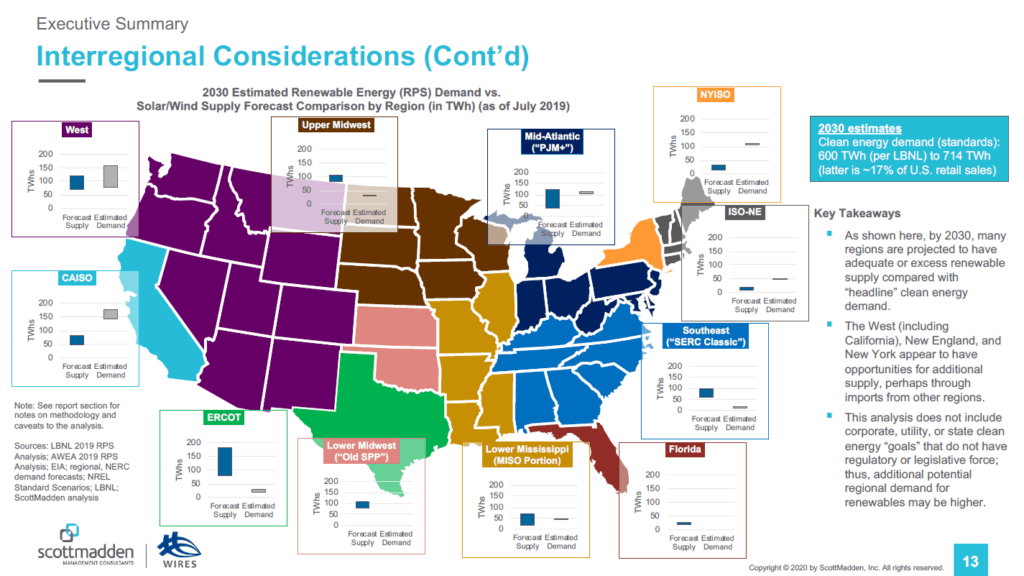

Often the best solar power and wind resources are found in relatively remote areas – for example, the best wind resources are found in the Great Plains, while the best solar is found in the southeastern and southwestern United States. In many cases, inadequate or overly congested transmission infrastructure prevents this electricity from being transported from where it is lowest cost to generate to the population and industrial centers where it is needed the most – ultimately raising costs for consumers and frustrating clean energy goals. While a few major transmission projects across the country are still moving ahead, each with the opportunity to unlock significant amounts of renewable energy, they are largely the exception, not the rule. The fact is, many states run the risk of not being able to source enough clean energy to cost-effectively meet their goals. New England, New York, and California all have energy demands that are set to outpace forecasted supply by 2030, unless they are able to import significant amounts of additional electricity from other regions.

The report highlights the extent of this problem, providing a region-by-region analysis of the nation’s transmission infrastructure and the challenges each area of the country is facing. In particular, the report notes many of the issues with transmission are inherently regional. Each location has a unique mix of existing infrastructure and resource potential, and states have distinct roles in the siting and permitting of transmission. WSA agrees that many of the issues identified in the report are indeed barriers to rapidly scaling more renewables onto the grid: These include:

- Siting and Permitting: Transmission projects will often cross multiple legal jurisdictions, requiring state-by-state approval. This slows down projects significantly, with many multi-state transmission lines taking well over a decade to plan, permit, and construct.

- Order 1000: In 2010, the Federal Energy Regulatory Commission (FERC) issued Order 1000, which gave regional transmission organizations (RTOs) some guidance on developing interregional transmission lines. However, in the past 10 years, only one interregional project has been identified.[4] Cost-allocation challenges remain, particularly across regions with different methodologies. Often, transmission projects crossing RTOs are subject to what is known as the “triple hurdle” – a project must undergo a cost-benefit analysis in each region and then be subject to a third, interregional cost-benefit analysis.

- Evolution of Incentives Policy: The Energy Policy Act of 2005 directed FERC to develop incentive-based rates for electric transmission. However, FERC’s current “risks and challenges” framework has been insufficient in spurring needed investment. FERC does not use a model that grants transmission incentives based on a full accounting of the benefits to customers. Nor does FERC place emphasis on projects needed to meet public policy goals, such as state carbon reduction targets, leaving an original intent of Order 1000 unrealized.

Ultimately, the report suggests it is up to states to communicate their clean energy requirements to RTOs to help them understand the degree to which future growth must be facilitated by new and upgraded transmission. Without a strategic and timely expansion of infrastructure, states’ ability to provide customers with affordable electricity – and meet their clean energy mandates – may be in jeopardy.

[1] Energy Innovation, https://energyinnovation.org/wp-content/uploads/2019/04/Coal-Cost-Crossover_Energy-Innovation_VCE_FINAL2.pdf.

[2] Sierra Club, https://www.sierraclub.org/ready-for-100/commitments.

[3] ESIG, modeling using NREL data, available on request; NRDC, America’s Clean Energy Frontier (2017), available at, https://www.nrdc.org/sites/default/files/americas-clean-energy-frontier-report.pdf.

[4] Amanda Durish Cook, MISO, PJM Poised for 1st Major Interregional Project, RTO Insider, https://rtoinsider.com/miso-pjm-first-major-interregional-project-145627/.